- Organizers in Pacoima finalized a CBA for a new shopping center. The CBA has a good local hiring program and also prohibits the developer from renting space to check cashing companies. The project itself will benefit the community by improving what's now a brownfield, and by bringing jobs and new retail to the city. See Kerry Cavanaugh, Mayor Saw Potential in Costco, Pacoima Pairing, The Daily News of Los Angeles, Jul. 28, 2008. For an update on the project, see this January 2009 press release from the Los Angeles Community Redevelopment Agency.

- In Richmond, the city council hasn't wasted any time getting the CBA fund committee set up--they appointed themselves.

- And the Yankees Stadium Community Benefits fund, although it was delayed it getting set up, has finally given out some major grants. The New York Daily News reports that they gave out $261,000 to 15 grant recipients yesterday.

Kamis, 31 Juli 2008

Thursday's CBA news.

Minggu, 27 Juli 2008

Some criticism of the Chevron CBA

Gayle McLaughlin, the Mayor of Richmond, and Tom Butt, a city council member, contributed an editorial to the Contra Costa Times yesterday criticizing the recent approval of the Chevron refinery upgrades. They had this to say about the so-called CBA:

The Community Benefits Agreement was negotiated between members of the council majority and Chevron and sprung on a few other surprised City Council members minutes before the July 15 hearing.

No public input or even public comment was allowed. Although gigantic flaws in the agreement came to light under questioning by other council members, the majority shut their ears and soldiered on to adoption.

Examples of egregious provisions are as follows:

- $14.6 million for "Alternative Energy Funding" is in fact a simple business venture by Chevron. Chevron will spend this amount for renewable energy projects producing electricity it intends to sell to the city, retaining greenhouse gas offsets and tax credits for itself.

- $6 million for "Environmental Benefits" will not come to the city at all. The "Environmental Benefits" are in fact watered-down versions of legitimate mitigations removed by the council majority from the conditional use permit. The money would be used by Chevron to pay for things like tank domes to reduce VOCs and ground level air monitoring, which the original CUP would have required anyway.

Stripped of all its scams, the Community Benefits Agreement is worth maybe $6 million, about the same amount Chevron used to buy off the City Council in 1994, not adjusted for inflation, which would make it even worse.

- $5 million for the Bay Trail will not come to the city either. In the majority's version, $3 million of it is Chevron's grossly overestimated value of a small piece of land for a trail easement, and $2 million is for security upgrades along the trail to benefit Chevron, not the city. There is no money for the original CUP requirement for Chevron to donate right of way and pay for construction of a Bay Trail connection to the Point San Pablo Peninsula, replacing a dangerous bike route along I-580 that resulted in one death and one serious injury two years ago.

Richmond has been taken to the cleaners by this secret deal which sacrifices our health, environmental justice and democratic processes for a few paltry million dollars.

Rabu, 23 Juli 2008

More on the Columbia expansion.

The Observer ran an article yesterday, Zero Hour in West Harlem, that looks at the coming eminent domain battle in West Harlem.

Also see Will Columbia Take Manhattanville?, which was published a few months ago, for background on the opposition. (Although I don't agree with the statement in this article that "relying on negotiating a community-benefits agreement before decisions about land use and zoning are finished amounts to 'purchasing' planning decisions." In the Columbia expansion case, where the CBA was negotiated primarily by local elected officials, this might be somewhat true. But that's not the way that CBAs are supposed to work--land use decisions and CBAs should inform each other, but neither should eclipse the other.)

Also see Will Columbia Take Manhattanville?, which was published a few months ago, for background on the opposition. (Although I don't agree with the statement in this article that "relying on negotiating a community-benefits agreement before decisions about land use and zoning are finished amounts to 'purchasing' planning decisions." In the Columbia expansion case, where the CBA was negotiated primarily by local elected officials, this might be somewhat true. But that's not the way that CBAs are supposed to work--land use decisions and CBAs should inform each other, but neither should eclipse the other.)

Selasa, 22 Juli 2008

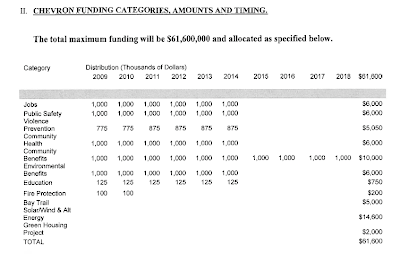

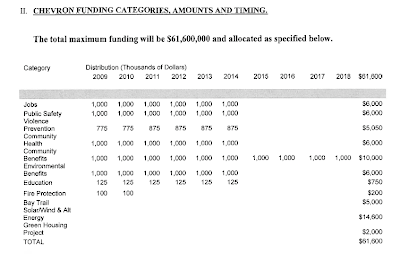

More on the Chevron refinery CBA.

Here's a copy of the so-called CBA entered into between the City of Richmond and Chevron last week (so-called because, like the Yankee Stadium CBA, no community groups helped to negotiate it).

The agreement sets out more than $60 million in benefits, but it's a bit light on the oversight provisions (there should be provisions for public oversight, and at a minimum the agreement should have provided for public dissemination of reports prepared by Chevron and the city). There are also no real benchmarks--no requirements for local hiring or goals for the number of people that the city hopes to enroll in pre apprenticeship programs.

Interestingly, like the Yankee Stadium agreement, a good portion of the money ($10 million) is going to be put into a community trust fund to be administered by a committee consisting of city and Chevron appointees. Hopefully this committee can avoid some of the problems that the Yankee Stadium fund advisory panel has had with delayed distribution of funding.

The agreement sets out more than $60 million in benefits, but it's a bit light on the oversight provisions (there should be provisions for public oversight, and at a minimum the agreement should have provided for public dissemination of reports prepared by Chevron and the city). There are also no real benchmarks--no requirements for local hiring or goals for the number of people that the city hopes to enroll in pre apprenticeship programs.

Interestingly, like the Yankee Stadium agreement, a good portion of the money ($10 million) is going to be put into a community trust fund to be administered by a committee consisting of city and Chevron appointees. Hopefully this committee can avoid some of the problems that the Yankee Stadium fund advisory panel has had with delayed distribution of funding.

Senin, 21 Juli 2008

Substance vs Form in Transfer Pricing

Latin American tax authorities rely heavily on the formality requirements, which are based on the opposite to the bona fide principle, which assumes the good intentions of the parties.

Three cases where recently decided by Argentine Courts dealing with the "substance vs form" in intra-group financing and services.

In Compañía Ericsson S.A.C.I. (Federal Tax Court, August 15, 2007), the subsidiary of the Swedish telecommunications multinational, obtained a loan from one of the group’s financial vehicles, whose terms and conditions, but for the formal instrumentation, were unquestionably arm's-length.

The loan was formalized in a memo disclosing the parties' names, purpose, amount, and interest rate, but lacked the signature of the borrower. The Argentine Internal Revenue Service re-characterized the debt as equity on the grounds that independent parties would have met certain formalities where the taxpayer did not.

Even though the Tax Court in this case reversed the assessment based on the prevalence of substance over form for transfer pricing purposes (following sections 1.10, 1.28 and 1.29 of the OECD Guidelines), the message between the lines was that under the tax authority's approach, meeting all civil law and administrative formalities seems to play a very prevalent role (for example: entering into a written contract, signing before a notary, obtaining the Apostille according to The Hague Convention, translation of documents not in Spanish by certified public translator, certification of transfer pricing report by certified public accountant, legalization of professionals' signatures with the relevant professional association, registration with the Patent and Trademark office, etc).

Litoral Gas S.A. (Administrative Litigation Court of Appeals, Room II, April 17, 2008), the natural gas distribution utility ultimately owned by Suez-Tractebel from Belgium and Techint from Argentina, also was granted an intra-group loan, but the outcome rendered by the Court of Appeals confirmed the “form over substance” approach used by the Fisc.

The interest deduction was denied to the taxpayer, decision that was neither grounded on thin capitalization nor on transfer pricing evaluations.

Based on expert witness opinion delivered to the tribunal, the instrumentation by the company of the agreement evidencing the loan with Tractebel from Belgium and Netherlands did not meet the formality requirements to be considered a specific date valid vis a vis third parties (according to Civil Code Section 1035: filing the document with a court or public body, recognition before a notary and two witnesses, transcription in any official record, death of any of the signers).

Here is another example. J.W. Thompson Argentina S.A. (Administrative Litigation Court of Appeals, August 24, 2006), the subsidiary of the U.S. advertising agency, incurred various expenses outside of Argentina (for advertising materials, travel, and shipping among other things) that vendors invoiced to the U.S. headquarters, which in turn attached a copy to "advice memos" and passed them through to the local entity.

The Court of Appeals affirmed the Tax Court decision denying deductibility of charges not invoiced directly to the Argentine taxpayer or included in "advice memos," as not meeting the formality standards to be considered as serious evidence of the expenses.

All posts will be appreciated, as well as comments by phone at +5411 4776 8200, by email at daniel@enterpricing.com or at http://www.enterpricing.net/contactus.htm.

Daniel Rybnik, Partner, EnterPricing

www.enterpricing.com

Three cases where recently decided by Argentine Courts dealing with the "substance vs form" in intra-group financing and services.

In Compañía Ericsson S.A.C.I. (Federal Tax Court, August 15, 2007), the subsidiary of the Swedish telecommunications multinational, obtained a loan from one of the group’s financial vehicles, whose terms and conditions, but for the formal instrumentation, were unquestionably arm's-length.

The loan was formalized in a memo disclosing the parties' names, purpose, amount, and interest rate, but lacked the signature of the borrower. The Argentine Internal Revenue Service re-characterized the debt as equity on the grounds that independent parties would have met certain formalities where the taxpayer did not.

Even though the Tax Court in this case reversed the assessment based on the prevalence of substance over form for transfer pricing purposes (following sections 1.10, 1.28 and 1.29 of the OECD Guidelines), the message between the lines was that under the tax authority's approach, meeting all civil law and administrative formalities seems to play a very prevalent role (for example: entering into a written contract, signing before a notary, obtaining the Apostille according to The Hague Convention, translation of documents not in Spanish by certified public translator, certification of transfer pricing report by certified public accountant, legalization of professionals' signatures with the relevant professional association, registration with the Patent and Trademark office, etc).

Litoral Gas S.A. (Administrative Litigation Court of Appeals, Room II, April 17, 2008), the natural gas distribution utility ultimately owned by Suez-Tractebel from Belgium and Techint from Argentina, also was granted an intra-group loan, but the outcome rendered by the Court of Appeals confirmed the “form over substance” approach used by the Fisc.

The interest deduction was denied to the taxpayer, decision that was neither grounded on thin capitalization nor on transfer pricing evaluations.

Based on expert witness opinion delivered to the tribunal, the instrumentation by the company of the agreement evidencing the loan with Tractebel from Belgium and Netherlands did not meet the formality requirements to be considered a specific date valid vis a vis third parties (according to Civil Code Section 1035: filing the document with a court or public body, recognition before a notary and two witnesses, transcription in any official record, death of any of the signers).

Here is another example. J.W. Thompson Argentina S.A. (Administrative Litigation Court of Appeals, August 24, 2006), the subsidiary of the U.S. advertising agency, incurred various expenses outside of Argentina (for advertising materials, travel, and shipping among other things) that vendors invoiced to the U.S. headquarters, which in turn attached a copy to "advice memos" and passed them through to the local entity.

The Court of Appeals affirmed the Tax Court decision denying deductibility of charges not invoiced directly to the Argentine taxpayer or included in "advice memos," as not meeting the formality standards to be considered as serious evidence of the expenses.

All posts will be appreciated, as well as comments by phone at +5411 4776 8200, by email at daniel@enterpricing.com or at http://www.enterpricing.net/contactus.htm.

Daniel Rybnik, Partner, EnterPricing

www.enterpricing.com

Jumat, 18 Juli 2008

The Columbia expansion moves ahead: eminent domain and more concessions

On Tuesday, Nick Sprayregen, the owner of Tuck-it-Away Storage and one of the last property owners in the Columbia expansion footprint not to reach a deal with the university, got a win in state court. The case, Tuck-it-Away Associates, LP v. Empire State Development Corporation, involved a Freedom of Information Law (FOIL) request, and the appellate division ruled that Empire State Development Corporation (ESDC) could not withhold documents prepared in connection with its blight study because the consultant that prepared the study has also been working with Columbia. ESDC had claimed that the documents fell within the FOIL exception for intra- or inter-agency documents, but the court held that "such communications lose their exemption if there is reason to believe that the consultant is communicating with the agency in its own interest or on behalf of another client whose interests might be affected by the agency action addressed by the consultant." In that regard, the court found that the consultant, AKRF, was acting as an advocate for Columbia and that the documents, therefore, were not exempt from disclosure.

On Tuesday, Nick Sprayregen, the owner of Tuck-it-Away Storage and one of the last property owners in the Columbia expansion footprint not to reach a deal with the university, got a win in state court. The case, Tuck-it-Away Associates, LP v. Empire State Development Corporation, involved a Freedom of Information Law (FOIL) request, and the appellate division ruled that Empire State Development Corporation (ESDC) could not withhold documents prepared in connection with its blight study because the consultant that prepared the study has also been working with Columbia. ESDC had claimed that the documents fell within the FOIL exception for intra- or inter-agency documents, but the court held that "such communications lose their exemption if there is reason to believe that the consultant is communicating with the agency in its own interest or on behalf of another client whose interests might be affected by the agency action addressed by the consultant." In that regard, the court found that the consultant, AKRF, was acting as an advocate for Columbia and that the documents, therefore, were not exempt from disclosure.Nevertheless, the decision only means that ESDC will have to disclose additional documents to the property owners. And even though the court was rather critical of AKRF's working for both Columbia and ESDC, ESDC announced yesterday that it had commissioned a second blight study prepared by a different firm (although still paid for by Columbia). ESDC also adopted the General Project Plan (GPP) (pdf) for the expansion yesterday. The GPP relies on ESDC's approval of the blight studies, both of which found that "the area surrounding the project’s 17 buildings was mainly characterized by aging, poorly maintained and functionally obsolete industrial buildings, with little indication of recent reinvestment to revive their generally deteriorated conditions." With this finding, ESDC and Columbia are set to kick off any eminent domain proceedings needed to acquire the last few holdout properties in the footprint.

Additionally, ESDC also revealed yesterday that Columbia has agreed to more concessions:

- "$20 million in funds for the Harlem Community Development Corporation to focus on community development and planning.

- $1 million for expanded CUNY Health Science and Medical Technician training.

- Annual undergraduate and Lifelong Learner scholarships for area residents, including local NYCHA tenants.

- A goal of 40% MWL workforce participation for construction jobs related to project.

- Provision of a mobile dental center for preschool children, space for senior service programming and a center on disease education for children K-12.

- Columbia University will also partner with local middle and high schools to develop and implement math and science course support."

For the New York Times' coverage, see here. The Observer has some commentary on this flurry of events too. See here and here.

More on the Chevron plant in Richmond

On June 19, the Richmond Planning Commission approved of Chevron's plans to upgrade its refinery, but it attached about 70 provisions to the approval. Both Chevron and its opponents appealed this decision to the City Council, which voted 5-4 yesterday to approve Chevron's plan. The City Council rejected project opponents' demands for a crude cap, which has been a contentious issue for months.

Apparently the CBA proposed for the project also generated some controversy. The last time I posted about this project, the Planning Commission had removed the CBA provisions from the plan, claiming that it was unfair. However, the City Council approved the CBA by a 6-1 vote. This may, in fact, have been a new CBA, since one of the council members claimed that "it first came to public light 20 hours ago."

The CBA, according to news reports, includes:

Environmental groups are poised to file a lawsuit to prevent the upgrades from going forward.

Apparently the CBA proposed for the project also generated some controversy. The last time I posted about this project, the Planning Commission had removed the CBA provisions from the plan, claiming that it was unfair. However, the City Council approved the CBA by a 6-1 vote. This may, in fact, have been a new CBA, since one of the council members claimed that "it first came to public light 20 hours ago."

The CBA, according to news reports, includes:

- $6.8 million for job training and placement;

- $11.3 million for public safety;

- $6 million for a local health clinic;

- $10 million for local nonprofits;

- $5 million for the Bay Trail;

- $14.6 million for alternative energy programs; and

- $5 million for environmental mitigation.

Environmental groups are poised to file a lawsuit to prevent the upgrades from going forward.

Selasa, 15 Juli 2008

Neighborhood group seeks (and fails) to get a CBA requirement attached to rezoning

Neighborhood organizers in the town of Madison, Wisconsin, sought to have a CBA requirement attached to a rezoning petition on Friday night, but they left the meeting agreeing not to oppose the rezoning. The rezoning will allow the development of the $120 million Novation campus, and the developer is hoping to get approvals quickly in order to ensure the retention of tenants.

County officials refused to attach any CBA conditions to the rezoning, explaining that this would be illegal contract zoning. (Contract zoning refers to situations where the zoning authority agrees to grant a rezoning or not based on whether the petitioner agrees to certain conditions. While a rezoning conditioned on the negotiation of a CBA would almost certainly be found to be contract zoning, it has long been settled law in Wisconsin (and elsewhere) that a zoning authority may consider private restrictions on the land when deciding whether or not to rezone property. See State ex rel. Zupancic v. Schimenz, 46 Wis. 2d 22 (1970). So, the neighborhood group should have been pushing the developer to negotiate, rather than pushing the county to force the developer to negotiate.)

By the end of the meeting on Friday, the neighborhood group had agreed not to oppose the rezoning petition, and the developer had promised to engage the neighborhood group in its community development plans. One of the group's primary issues is having a community garden space, and the developer agreed to consider extending the lease on the current garden.

County officials refused to attach any CBA conditions to the rezoning, explaining that this would be illegal contract zoning. (Contract zoning refers to situations where the zoning authority agrees to grant a rezoning or not based on whether the petitioner agrees to certain conditions. While a rezoning conditioned on the negotiation of a CBA would almost certainly be found to be contract zoning, it has long been settled law in Wisconsin (and elsewhere) that a zoning authority may consider private restrictions on the land when deciding whether or not to rezone property. See State ex rel. Zupancic v. Schimenz, 46 Wis. 2d 22 (1970). So, the neighborhood group should have been pushing the developer to negotiate, rather than pushing the county to force the developer to negotiate.)

By the end of the meeting on Friday, the neighborhood group had agreed not to oppose the rezoning petition, and the developer had promised to engage the neighborhood group in its community development plans. One of the group's primary issues is having a community garden space, and the developer agreed to consider extending the lease on the current garden.

Langganan:

Komentar (Atom)